M&A: Page 8

-

Fiserv expands restaurant reach with BentoBox purchase

The global payments processor said it would buy BentoBox to expand the reach of its Clover unit in servicing restaurants.

By Lynne Marek • Oct. 19, 2021 -

BurgerFi acquires pizza chain for $161.3M

Just over a year after it went public, the fast casual burger chain landed its first purchase, making Anthony's Coal Fired Pizza & Wings part of its strategy to become a multibrand platform.

By Emma Liem Beckett • Oct. 11, 2021 -

Reef Technology's expansion

Reef Technology acquires logistics partner Bond

The acquisition strengthens Reef's distribution capacity, which will now include Bond's last-mile delivery nano-warehouses.

By Emma Liem Beckett , Aneurin Canham-Clyne • Oct. 7, 2021 -

BBQ Holdings will buy Tahoe Joe's Famous Steakhouses

This acquisition comes just a few months after the restaurant group bought Village Inn and Bakers Square for $13.5 million.

By Emma Liem Beckett • Oct. 7, 2021 -

Kitchen United buys Zuul, entering New York City market

After announcing one of the first acquisitions in the ghost kitchen segment, the company's chief business officer said there's potential for more deals as it looks to expand geographically.

By Aneurin Canham-Clyne • Oct. 4, 2021 -

Fat Brands to acquire Twin Peaks for $300M

The deal marks Fat's entry into "polished casual dining," a departure from its rosters of QSR, fast causal and casual restaurant brands, and is the company's second major purchase this summer.

By Emma Liem Beckett • Sept. 1, 2021 -

Sweetgreen acquires automated restaurant company Spyce

The salad chain plans to use the Boston-based firm's robot-powered technology in its restaurants to improve the guest and employee experience.

By Julie Littman • Aug. 24, 2021 -

Tocaya and Tender Greens merge, form new parent company

The Los Angeles-based fast casuals boast a combined 45 locations in California and Arizona and are looking to drive rapid growth through traditional and potentially nontraditional channels.

By Julie Littman • Aug. 4, 2021 -

High Bluff Capital buys Church's Chicken

Under High Bluff's Rego Restaurant Group, which recently partnered with Ghost Kitchen Brands, the chain could access new paths to innovation.

By Julie Littman • Updated Aug. 2, 2021 -

California Pizza Kitchen mulling sale or IPO, Bloomberg reports

The casual chain's annualized earnings for June are expected to be more than $10 million higher than they were before the pandemic, per Bloomberg.

By Alicia Kelso • July 26, 2021 -

Deep Dive

Why restaurant M&A activity is spiking after pandemic lull

As diner demand helps restaurant sales recover, buyers are jumping back into the game amid low interest rates and as financing becomes more widely available.

By Julie Littman • July 21, 2021 -

J. Alexander's Holdings sold to SPB Hospitality for $220M

The deal between the upscale dining chain and the parent company of Logan's Roadhouse and Gordon Biersch Brewery Restaurant is expected to close in Q4 2021.

By Emma Liem Beckett • July 2, 2021 -

Jack in the Box franchisee to buy Taco Cabana for $85M

Fiesta Restaurant Group sold the brand to YTC Enterprises, an affiliate of Yadav Enterprises. The sale leaves Fiesta with just Pollo Tropical in its portfolio.

By Alicia Kelso • July 1, 2021 -

Au Bon Pain sold to Yum Brands franchisee

The café chain's parent company had planned to sunset the brand, Ampex Brands' CEO said, but Ampex is now looking to expand it beyond the 171 locations it acquires in this deal.

By Emma Liem Beckett • June 30, 2021 -

Fat Brands to acquire Global Franchise Group for $442.5M

The company is adding five QSR brands, including Great American Cookies and Round Table Pizza, to its portfolio less than a year after buying Johnny Rockets.

By Julie Littman • Updated June 28, 2021 -

BBQ Holdings to buy Village Inn, Bakers Square for $13.5M

The deal marks the holding company's first acquisition since it bought Granite City Food & Brewery and Real Urban in 2020.

By Julie Littman • June 25, 2021 -

Luby's to sell cafeteria business for $28.7M

A newly formed affiliate of Calvin Gin has entered into an agreement to purchase 32 existing units, all of which are in Texas, and ownership of the Cafeteria brand.

By Julie Littman • June 21, 2021 -

Luby's sells Fuddruckers for $18.5M

The company sold the restaurant to Black Titan Franchise Systems as part of its liquidation plan.

By Julie Littman • June 18, 2021 -

Grubhub promotes CFO Adam DeWitt to CEO

Following the completion of Just Eat Takeaway's acquisition, Grubhub founder and CEO Matt Maloney will join JET's management board.

By Julie Littman • June 16, 2021 -

Restaurant365 acquires restaurant management platform Compeat

Both companies provide similar solutions aimed at simplifying day-to-day operations, including accounting, inventory, scheduling, payroll and HR management, and the combined firm will serve over 28,000 restaurants.

By Alicia Kelso • June 14, 2021 -

Toast buys back-office tech provider

The acquisition will allow the POS company to offer insights into profitability by menu item, as well as automation and intelligence tools to streamline tasks like managing inventory and tracking margins.

By Julie Littman • June 11, 2021 -

Yum to acquire AI-based company Dragontail Systems for $72.3M

Yum plans to scale the tech globally. Nearly 1,500 Pizza Hut locations across 10 countries already use the technology, which automates operations from the kitchen flow through the delivery process.

By Julie Littman • May 27, 2021 -

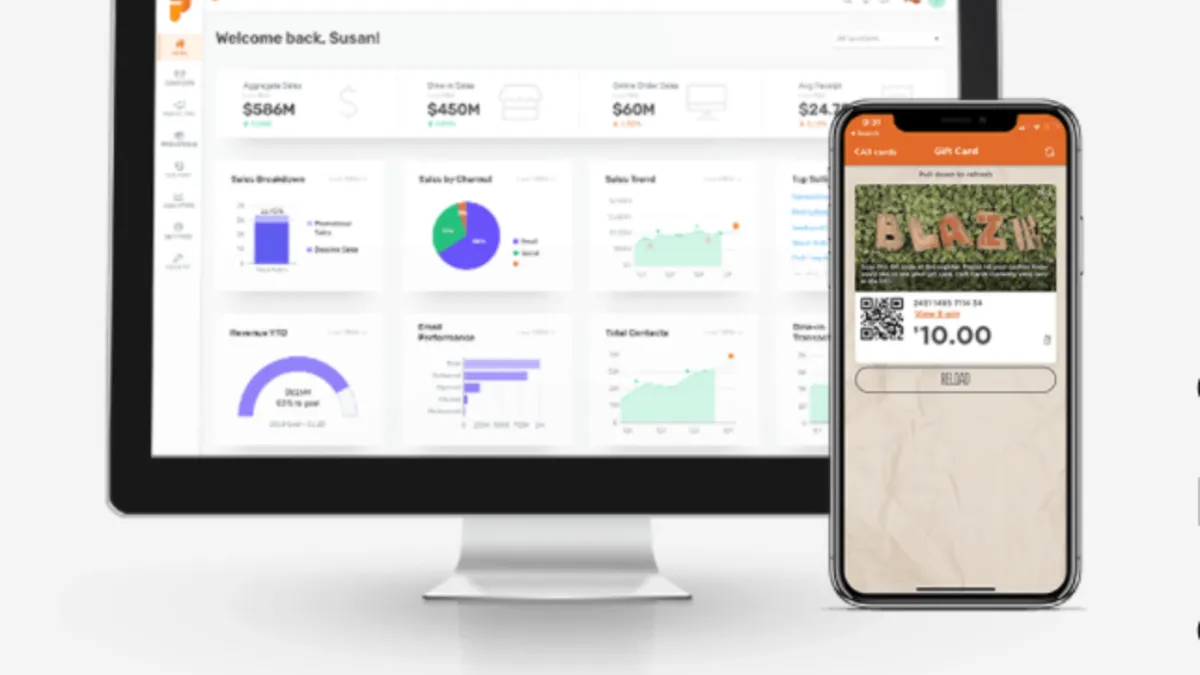

Retrieved from Punchh on April 09, 2021

Retrieved from Punchh on April 09, 2021

Par Technology expands into loyalty with $500M Punchh acquisition

The addition of the loyalty and guest engagement firm will help Par create an all-in-one cloud platform for its 100,000-plus global restaurant clients.

By Julie Littman • April 9, 2021 -

Squarespace buys reservation platform Tock for $400M

The acquisition comes a year after Tock pivoted from offering pre-paid reservations to providing a resource for restaurants to add an online takeout and delivery menu.

By Julie Littman • April 1, 2021 -

Delight Restaurant Group adds 54 Wendy’s from NPC International sale

With the acquisition, the franchisee will operate 111 Wendy's and Taco Bell locations across four states.

By Alicia Kelso • March 29, 2021