Dive Brief:

- Taco Bell and KFC both posted same-store sales growth in the U.S. in Q4 2025 of 7% and 1%, respectively, according to Yum Brands’ earnings release.

- KFC’s results marked the second consecutive quarter of comps growth for the chain in the U.S. after a long period of slipping sales.

- Yum has worked to align the strategies between the two QSR brands in hopes of bringing some of Taco Bell’s success — consistent same-store sales growth and a 40% increase in system sales since 2021 — to KFC, especially in the U.S., per the company’s earnings call.

Dive Insight:

CEO Chris Turner said Yum’s major strategic priority is “battling for the future consumer” and that it is looking to strengthen KFC by implementing many of the strategies that have made Taco Bell a dynamic and consistently growing brand.

KFC Division CEO Scott Mezvinsky, who spent years as president of Taco Bell North America and International, is “taking a page from the magic formula playbook at Taco Bell,” Turner said.

At Taco Bell, that formula has blended value-based menu design with premium or buzzy limited-time offerings including recurring menu items. In 2025, KFC employed similar tactics, bringing back Hot n’ Spicy Wings and Potato Wedges after consumer clamor. In January, the chicken chain began advertising $5 bowls that mixed chicken nuggets with sides as a play for value-oriented lunch consumers.

Taco Bell has also used its spin-off concepts, Taco Bell Cantina and the Live Mas Cafe, as testing grounds for premium menu items and beverage concepts. That menu innovation is backed by Yum’s Collider Labs, a division that aggregates large amounts of consumer data to help determine which flavors and items might be ripe for QSR deployment.

Now, Turner said, KFC is looking to use Collider's data to “re-engineer the menu and calendar and continuously evolve and modernize the brand.” The chain will increase the pace of its marketing windows and use new partnerships to drive cultural relevance.

In 2026, KFC will deploy its Kwench beverage platform to about 3,000 stores, though Turner did not say which markets would begin selling new drinks. The brand is also refining its chicken tenders by adjusting the crispiness of its chicken, tweaking portion sizes and building up a sauce innovation pipeline through Saucy, another spin-off concept.

Similar efforts at Taco Bell have driven consistent sales growth in recent years, and the brand is “taking share broadly from a broad range of competitors,” Turner said.

In Q4, Taco Bell saw transaction growth across income bands and with younger consumers and families; the chain’s transactions did grow more rapidly for higher-income consumers, though.

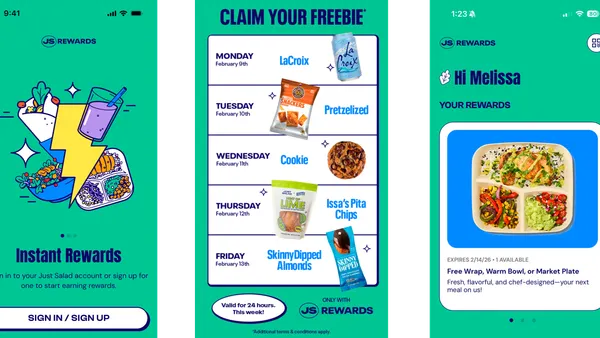

Taco Bell’s digital strategy has also helped funnel consumers into the brand’s digital channels and loyalty program.

Yum’s efforts to build its own digital platform, Byte, give it an advantage over its competitors, Turner said. Digital sales increased by 20% year over year, with those channels accounting for 60% of sales worldwide.

But the news is not universally good for Yum. The successes at Taco Bell and KFC International, and KFC’s ongoing U.S. turnaround, come at a moment when Yum’s third largest brand, Pizza Hut, is struggling to grow sales. Pizza Hut will close 250 underperforming units in the U.S., and Yum may eventually sell the chain.