Dive Brief:

- Toast’s menu price monitor revealed that prices for items like beer and wings are rising slower than the general rate of inflation, which was 3% for all items and 3.7% for food away from home in September, according to the Bureau of Labor Statistics.

- Of the menu items tracked by Toast, cold brew coffee saw the most substantial increase — 4.2% year over year — with the median cold brew now costing about $5.49.

- As menu prices rise across the board, operators able to constrain increases on specific items could improve their value proposition relative to competitors.

Dive Insight:

Consumer price sensitivity has weighed heavily on restaurant traffic this year — major brands that have failed to articulate a compelling value message have seen sales and traffic declines. The cost of core entrees is a major factor in consumer price perceptions.

Prices for burritos and burgers both exceeded the rate of inflation for all goods, rising 3.2% and 3.1%, respectively. Median burrito prices have remained largely steady for the last few months, rising from $13.38 in May to $13.41 in September.

Burger prices, meanwhile, plateaued in spring and early summer at about $14.39 before rising to $14.48 in September. Toast attributed this trend to rising input costs — though the cost of burgers has lagged the cost of beef overall. The price of ground beef has risen by nearly 80 cents per pound this year, and is up 34 cents per pound since May, according to price data from the Federal Reserve Bank of St. Louis.

“The recent rise suggests that restaurants may be finally raising menu prices to offset some of the rising beef costs,” Toast said.

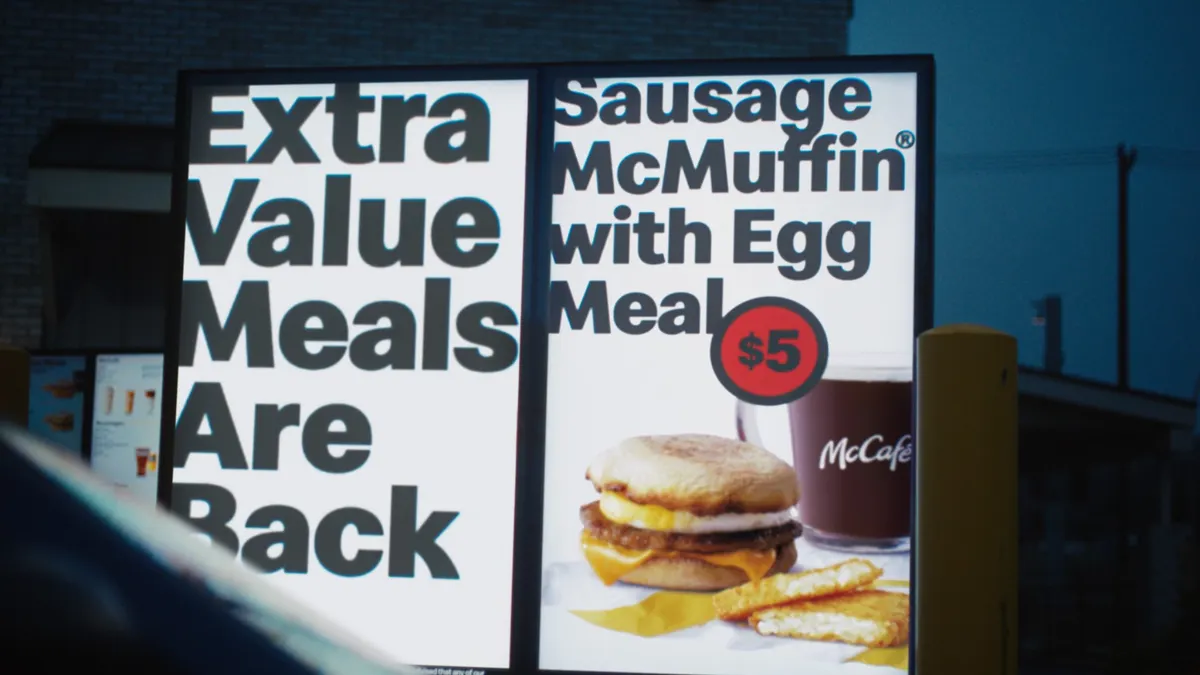

Major chains are working to constrain pricing on core menu items or to highlight value options as consumers look for cheaper alternatives. McDonald’s most recent value plays include price cuts on combos including the Big Mac and Quarter Pounder. Chipotle’s core entrees average around $10.31 depending on the market and the protein, several dollars below Toast’s reported median burrito price. Even including guacamole — which raises Chipotle’s average price to $13.12, the burrito brand still prices below Toast’s observed median.

Football season staples, beer and wings, have seen prices rise below the overall rate of inflation — with a 2.2% and 2.4% increase year over year. With many restaurants looking to capitalize on the NFL season, slower increases in these categories could help operators draw consumers.

Slower inflation in these menu items could also help casual dining continue its 2025 resurgence. Casual dining chains with bars have performed fairly well this year. Chili’s, of course, has seen meteoric traffic growth in recent quarters, but Applebee’s, long a laggard in the segment, has seen its traffic turn positive as well.

In coffee there was a sharp divergence between the price of cold brew, which rose 4.2%, and regular drip coffee, which rose 2.6%. Both beverages should see similar pricing pressure from supply problems. The difference in inflation may reflect consumer demand for cold drinks, which could give operators a greater ability to raise cold brew prices without losing traffic.