Dive Brief:

- Sweetgreen took a major blow to its same-store sales in Q3 2025, with a 9.5% decrease driven by an 11.7% fall in traffic and menu mix partly offset by a 2.2% increase in pricing, according to the chain’s earnings release.

- The decline was sharpest in the Northeast and Los Angeles, which account for about 60% of its comparison base. It also saw significant pullback among consumers aged 25-35, where the chain is over-indexed, CEO Jonathan Neman said on the brand’s earnings call.

- Other restaurant brands have also seen regionally concentrated problems in those areas this year, with Shake Shack’s sales slowest in the New York City market and the broader Northeast.Wingstop and Jack in Box posted sales declines in California and other markets that over-index with Hispanic consumers.

Dive Insight:

Sweetgreen is looking for ways to increase its transactions and improve its value proposition. One such measure the brand has already undertaken is an increase in protein servings to reinforce guest perception of value, CFO Jamie McConnell said on its earnings call.

While that might move the needle for some guests, it has also contributed to the erosion of restaurant-level margins, which fell from 20% in Q3 2024 to 13% this quarter. McConnell said the increased portions of chicken and tofu increased costs by 140 basis points.

The brand’s efforts to drive traffic through tweaks to its dishes or through new menu items have contributed, in protein’s case, to mounting losses and, in the case of the late Ripple Fries, to unacceptable operational complexity.

But Sweetgreen isn’t giving up on its menu innovation: the brand plans to test a “handheld product,” next year, CEO Neman said. The handheld could drive customer acquisition and market share gain in new dayparts, Neman said.

Later this month, Sweetgreen will also launch a steak bowl and steak plate to increase the variety of its menu, Neman said. In 2024, Sweetgreen launched steak as a protein in a bid to increase its dinner transactions. Eighteen months later, the daypart is still a weak point for the chain, seeing steeper declines in orders than the lunch period, Neman said.

The brand is working to communicate the quality of its ingredients and protein content to consumers, Neman said.

William Blair analyst Sharon Zackfia noted continuities between the chain’s current efforts to return to sales growth and previous moves.

“The recipe of how to bolster trends continues to center on improved operations and accelerated menu innovation, although neither has yet manifested in better results,” Zackfia wrote in a research note.

The chain is also “reviewing our menu and pricing architecture as we continue to strengthen our value proposition. We know that we can do a better job of creating clear entry prices and logical trade-up opportunities,” Neman said.

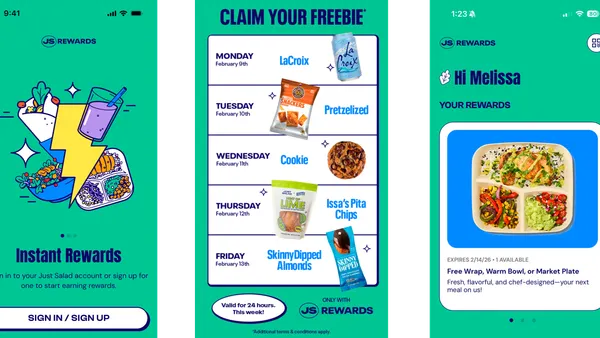

Neman told investors that the structure of Sweetgreen’s rewards program could be part of that review.

“We've gone in with relatively modest programmatic benefits. So it gives us a lot of opportunity to move up and also leverage more on the personalized offers in [customer relationship management],” Neman said. “We are evaluating all of it, including the potential for tiers and other benefits for members.”

The brand’s loyalty program, which launched earlier this year, replaced the Sweetpass and Sweetpass+ tiered subscription program. While the SG Rewards is a simpler, points-based loyalty program, the end of the subscription program contributed somewhat to the sales softness, according to Neman. However, the brand has seen positive frequency trends with its most loyal consumers, and will use SG Rewards to target less frequent users with targeted discounts and promotions over the next quarter, Neman said.