Dive Brief:

- Fast casual and QSR brands are seeing increased competitive pressure from value grocers, like Aldi and Trader Joe’s, and from casual dining chains emphasizing value, according to data from Placer.ai.

- This competitive landscape will push QSR brands to pair price-based value with menu innovation, LTOs and efforts to remain culturally relevant, R. J. Hottovy, head of Placer.ai’s analytical research, wrote in a report.

- The fast casual segment is facing particularly difficult conditions, as its pricing edge relative to casual dining has eroded, and many consumers have shifted toward a focus on holistic value, including on-premise experiences.

Dive Insight:

The dramatic uncertainty and variability of market conditions in 2025 marked a phase change for the restaurant sector, according to the report.

“The 'rising tide' era of post-pandemic growth is over; simply opening doors in high-growth Sunbelt markets or offering a generic discount is no longer enough to guarantee traffic,” Hottovy wrote.

Instead, grocers like Aldi and Trader Joe’s, retailers like Wawa and Buc-ee’s and wholesale clubs like Costco and Sam’s Club are eating into restaurant traffic.

The proportion of QSR consumers who also shop at Aldi has risen considerably in recent years, from 27% of McDonald’s consumers in 2021 to 36% in 2024. At Wendy’s, the figure increased from 28% to 41%, with similar increases at Burger King and Taco Bell. At the same time, frequency increased at Aldi.

“Some of the increase may be attributed to Aldi's expansion,” Hottovy wrote. “The rise in cross-visitation trends also underscores this competitive encroachment.”

Trader Joe’s is playing a similar role with respect to fast casual brands like Cava, Chipotle and Sweetgreen, Hottovy noted, though the brand’s growth explains some of its gains with fast casual consumers.

“We believe that some visitors have chosen to substitute some fast casual lunch visits for value grocers,” Hottovy wrote.

More worrying for these brands is the fact that traffic in middle-income trade areas is lagging overall traffic, suggesting fast casual is losing some of its cache with its core consumer base.

“Consumers began questioning the value of a $16 bowl eaten at a counter versus a $20 sit-down meal,” Hottovy said. “To win back these consumers in 2026, fast-casual brands must reinvest in the physical experience. This means moving away from ‘ghost kitchen’ vibes and back toward inviting dining rooms.”

Starbucks has made investments along those lines under CEO Brian Niccol, and has returned to traffic growth in its core markets after a dismal couple of years.

As Hottovy noted, many casual chains have followed in Chili’s footsteps, building value into price tiers on their menus and focusing their marketing on these offers, upping the pressure on QSRs and fast casuals.

“Competitors are validating Chili's core thesis: the new battleground for casual dining isn't service or ambiance, but proving they are the superior economic alternative to the quick-service sector,” Hottovy said.

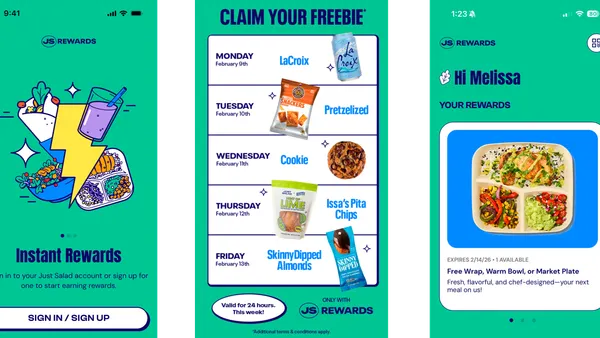

Hottovy said an emphasis on value, like Taco Bell’s Luxe value menu, could help, especially when combined with pop-culture tie-ins, freebies and clever sequencing of LTOs.