Dive Brief:

- Cracker Barrel is projecting a roughly 8% drop in traffic for Q1 of fiscal 2026 (August through October) following uproar over the chain’s scrapped logo redesign and store renovations, CFO Craig Pommells said on a Wednesday earnings call.

- The chain saw same-store sales rise 5.4% in Q4 fiscal 2025 — which ended before the logo controversy — according to an earnings release.

- The brand is projecting a 4% to 7% traffic decrease for the whole of fiscal 2026, Pommells said.

Dive Insight:

Some of that traffic trouble will be offset by lower capital expenditure over the next few years, which will come in far below the $600 million to $700 million three-year range Cracker Barrel shared at the start of fiscal 2025, President and CEO Julie Masino said. Those savings come from the end of the brand’s remodel program last week.

However, Masino said the brand will still spend heavily on in-store changes directed at improvements separate from modernizing remodels. That spending is defensive in nature, Masino said, focusing on repairs.

“The bulk of this will be maintenance CapEx, things like paints, parking lots, lighting, retail fixtures, flooring and restrooms as well as investments in technology to support our stores and our loyalty program,” Masino told investors and analysts.

Masino noted that the rebrand — which drew outrage from consumers and from conservative political figures, including the president — was only one part of the chain’s turnaround efforts.

“We are placing an even bigger emphasis in the kitchen and other areas that enhance the guest experience,” Masino said. The chain is working to make biscuits that satisfy consumer cravings and trigger nostalgia, alongside other menu moves.

Cracker Barrel has brought back consumer favorites, like Uncle Herschel’s Breakfast and chicken and rice, and added new menu items like pot roast and an improved New York strip steak, Masino said. Investments in labor and training brought back-of-house turnover down by 19% in two years and improved food quality, Masino said.

Those changes may have helped drive the chain’s momentum through fiscal Q4, which saw a meaningful bump in same-restaurant sales. The company also has reported five consecutive quarters of growth in that metric, Pommells said. Cracker Barrel anticipates sequential improvements in traffic over the following quarters.

“This is a bit of an unusual situation,” Pommells said.

There are reasons to think the storm may pass for Cracker Barrel. Masino highlights traffic-driving value options, including $8.99 early dinner deals, and the $7.99 Sunrise Special, an all-day deal pairing two pancakes with eggs or breakfast meat.

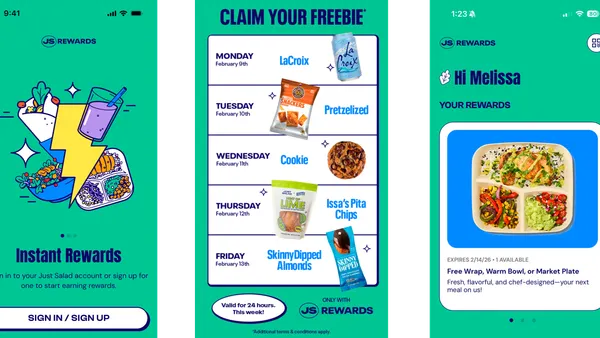

Then there’s the chain’s loyalty program, which “continues to grow and exceed expectations,” Masino said, adding that it was not meaningfully impacted by the logo trouble.

“Loyalty program sign-ups are actually ahead of our plan. We've signed up about 400,000 people quarter-to-date and 300,000 of those people have come in since 08/19, again, exceeding our plan,” Masino said.

But with high consumer price sensitivity and opaque macroeconomic prospects, traffic was down in aggregate for the restaurant industry across the first six months of 2025, according to data from the National Restaurant Association.

With visits flat or declining sectorally, restaurants face zero-sum competition for consumers. So far this year casual dining chains have been surprising winners in this competition, as inflation has weakened QSR and fast casual’s relative value proposition. But there’s no guarantee that this market dynamic will continue, especially with major QSRs like McDonald’s cutting core menu pricing, and fast casuals like Chipotle poised to follow with stronger value messaging.