Dive Brief:

- Cava’s same-store sales grew by 1.9% in the third quarter, with the increase driven mostly by pricing and mix shifts, according to the brand’s earnings release. Traffic at the fast casual chain was roughly flat.

- CFO Tricia Tolivar said the brand had seen some weakness among consumers from age 25 to 34, but that the brand’s traffic was strong, especially on a two-year basis, as 2024 was an exceptionally strong year for Cava.

- Cava downgraded its projected full-year same-store sales increase from the 4% to 6% range to the 3% to 4% range. The brand’s overall revenue still grew considerably, as it opened 74 restaurants since Q3 2024, including 17 in Q3 2025.

Dive Insight:

Cava is far from alone in facing a traffic stall. Across the fast casual sector, 2025 has been difficult. Chipotle posted two quarters of same-store sales declines and its Q3 recovery was anemic; Wingstop’s dramatic comps growth screeched to a halt and then reversed in the past two quarters.

Cava has seen a notable slowdown in the Washington, D.C., market at the start of Q4, as the government shutdown crimped consumer income in the region, Tolivar said. The chain does not anticipate this will have a significant impact on its sales, but was one of the factors included in the downward revision of its sales growth projections.

Cava is also reaching a broader cross-section of consumers across a wider range of geographies than in years past, according to data from Placer.ai. Cava’s expansion outside of city centers and high-income neighborhoods mean the median household income in areas surrounding a Cava location is about $95,000, compared to about $122,000 in 2019. Though that is still somewhat above the national median of $83,730 as measured by the Federal Reserve Bank of St. Louis

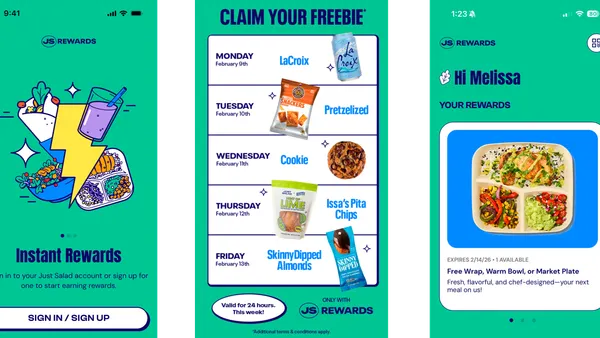

Tolivar said the brand raised prices about 1.7% earlier in the year and is seeing higher rates of attachment for side items, as well as growth in premium proteins, like its recently launched chicken shawarma and steak. Its loyalty program is also a key tool in driving frequency over time, and the chain recently added spend-based tiers to the system.

The chain offered a variety of loyalty perks during the quarter, like free pita chips or offers based on points accumulation, Tolivar said. But Cava is wary of relying on discounts as a traffic driving method because such moves could weaken the brand’s identity.

“We want to make sure that we're not responding to a short-term pressure that might have a long-term negative impact on the brand,” Tolivar said. “We want to stay steadfast on always serving incredible cuisine with amazing hospitality at a very reasonable price, and not deviate from that.”

The brand is looking to offer a value proposition that goes beyond a specific price point and encompasses food quality, experience and other elements, she said.

Tolivar said the brand’s Project Soul initiative is well under way and that Cava will implement all of the prescribed changes — warmer color palettes, softer seating, greenery, smoother lines, and warm ambiance — across all of its new stores by the end of 2026. Notably, the brand is making these changes without a significant increase in capital expenditure on a per-restaurant basis as its expansion gives it greater purchasing power and access to economies of scale when working with suppliers.