With no end in sight to the ongoing labor shortage, many fast food chains are turning to technology to help fill staffing gaps. About half of U.S. operators expect to deploy automation technology in the next two to three years, according to Lightspeed's 2021 Global State of the Hospitality Industry report. Thirty-seven percent of quick-service restaurant operators also said that technology was critical to their success, according to the report.

While the pandemic has made online ordering a table-stakes feature for operators, many chains are taking their technology investments a step further. From drones to autonomous delivery, restaurants are finding new ways to reach customers and improve the guest experience. Check out how these technologies and more are being deployed at QSR chains below.

Drone delivery

Pre-pandemic, eyes turned to the skies to witness some of the first test flights of drone delivery at select restaurant chains. Uber Eats tested drone deliveries between a McDonald's restaurant and San Diego State University in 2019, but Uber has since sold its Uber Elevate division, which was in charge of drone delivery.

El Pollo Loco embraced drone technology earlier this year through a partnership with Flytrex. This tie-up allowed the chain to offer its Air Loco service from 10 restaurants in Southern California, and marked Flytrex's first formal partnership with a QSR brand. Flytrex delivery orders take 10 to 12 minutes to complete versus 36 to 40 minutes via third-party aggregators. The service can also reduce delivery costs by 25% to 30%.

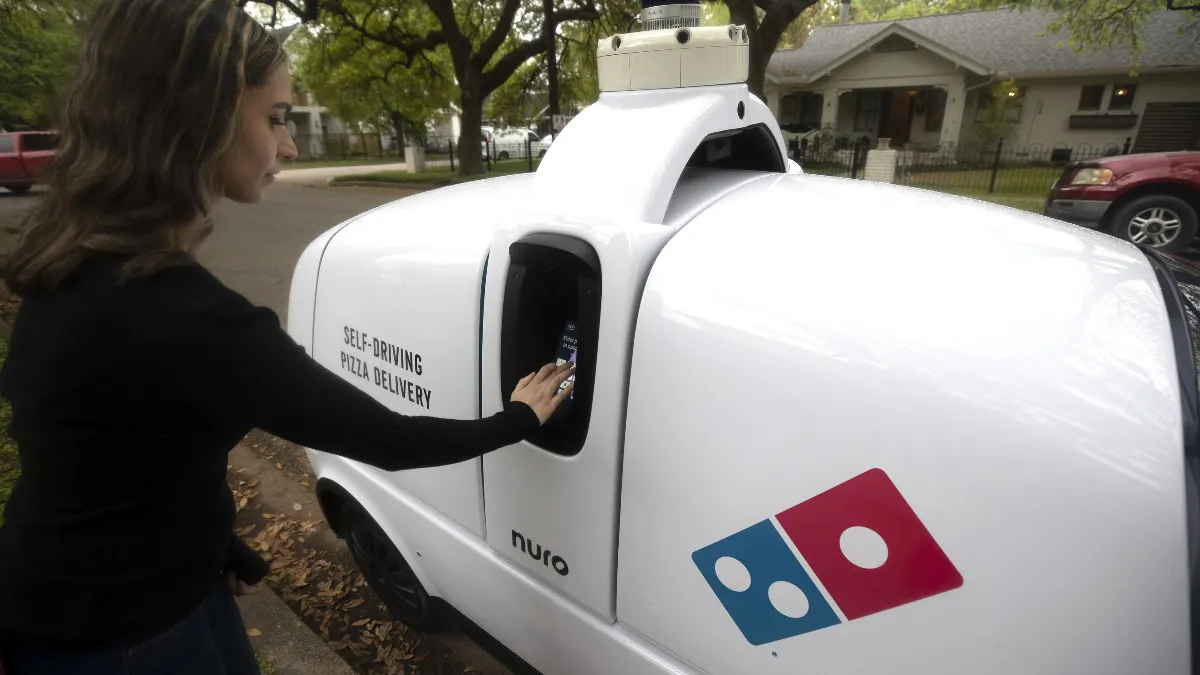

Autonomous vehicles

While Domino's has been looking into autonomous vehicle delivery with Nuro since 2019, it launched a test of the service this year in Houston. The company also unveiled a marketing campaign resurrecting its 1980's icon Noid to spotlight the driverless R2 vehicles. While Domino's hasn't yet said if it would expand this pilot program beyond Texas, the chain is using the program to understand how customers respond to deliveries by the driverless vehicles and the impact these cars might have on operations.

Chipotle also invested in Nuro earlier this year, marking its first major investment in a third-party company under CEO Brian Niccol’s leadership. This could provide additional opportunities to test traditional alternative delivery methods in the future.

Robot delivery

Third-party delivery companies have been among the first to pilot robot delivery, especially on college campuses. Bots can provide a more cost-effective way to deliver small orders short distances, since this method doesn’t deploy a courier.

Restaurants are beginning to invest here too. Chick-fil-A partnered with Kiwibot to deliver food from three locations in Santa Monica, California. These bots can provide service to customers up to a mile away, completing deliveries in about 30 minutes.

Artificial intelligence

A handful of major chains, including McDonald's and Burger King, have been expanding deployment of artificial intelligence at the drive-thru, using systems that can provide suggestive selling and add-ons. McDonald's is testing autonomous voice ordering as well as an autonomous fryer, while Krystal is piloting voice automation that can pick up different accents within its Southeast markets. But AI can go beyond the basics of taking orders and helping in the kitchen.

Yum Brands is using artificial intelligence gained through its acquisition of Dragontail Systems, which closed in September, to streamline end-to-end food preparation and enhance its delivery capabilities, CEO David Gibbs said during the company's Q3 2021 earnings call in October. The technology also simplifies the order process and optimizes delivery routes, decreasing delivery times, CFO Chris Turner said during the company's call. As of late October, the technology has been deployed in 13 markets across 1,700 Pizza Hut locations. Many of these locations have already seen a positive impact on sales, order fulfillment and customer satisfaction in stores, Turner said.

Wendy's plans to use computer vision — a form of AI that uses digital images, videos and other visual cues to provide information and take action — as part of its partnership with Google Cloud. The company could use the technology to create a system that can detect if drive-thru lines are too long. An Outback Steakhouse franchisee also tested computer vision technology with Presto in 2019 to track wait times and analyze customer interactions.

GPS

During the early days of the pandemic, many chains had to scramble to build curbside pickup systems, many of which required customers to call into stores to alert a staff member that they were parked out front. Chains have since streamlined this process using GPS technology. Panera, El Pollo Loco and Hooters are among the chains to deploy GPS-enabled curbside pickup service, which automatically sends alerts to team members upon a customer’s arrival.

Domino's has been using GPS since 2019 to improve delivery operations. Through its GPS tracking, customers receive an estimated delivery time and then an SMS notification when the order is two minutes away.